Married Filed Separate Which Tax Return to Use for Fafsa

Your FSA ID which you can create on fsaidedgovNote that students and parents will need to create their own FSA ID and keep it private. Additionally if the IRS Mar 09 2021 The payments will likely be based on the income you reported in your 2020 tax return but if you havent filed it yet the government will use your 2019 return to calculate how much youre owed Federal Tax Return Due Dates Chart Federal Tax Return Due Dates Chart Alert.

14 Costly Fafsa Mistakes To Avoid Forbes Advisor

May not be combined with other offers.

. Unemployment compensation an Alaska Permanent Fund dividend educator expenses an IRA deduction or the student loan interest. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½. Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year.

A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return. Im sure shes lying but can i not file as. Your federal income tax returns W-2s and other records of money earned.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. I filed my taxes easily claiming no one can claim me as a dependent but my mom still claimed me in taxes. Roth IRA Distribution Details.

These stimulus checks were based on 2019 tax returns or 2018 tax returns if a 2019 return wasnt yet available. If you had earnings in 2017 please include a copy of the W-2 form you received from your employer. Say your visitation order states the child should be brought back to your ex by dinner time on Sunday.

Unemployment compensation an Alaska Permanent Fund dividend educator expenses an IRA deduction virtual currency or the student. She says the IRS is red flagging our taxes but turbo tax has not said anything about my taxes being on hold or delay. These questions ask if a 2019 tax return was completed which return was or will be filed what the filing status was or will be and whether the student or parents filed a Schedule 1 or did so only to claim one or more of the following.

Information youll need to fill out the FAFSA. Feb 19 2020 Apparently age isnt just a. My mother claims that i cant file as independent until im 21 or older or no longer in college.

Please note that you will want to keep copies of all tax return information for all applicable years in which you have received or applied for PA State Grant aid since prior applications can be subject to review at any time. Your social security number and drivers license andor alien registration number if you are not a US. If a PA state tax return was filed then you should submit a copy of that return with the signed statement.

Direct contributions can be withdrawn tax-free and penalty-free anytime. These questions ask if a 2020 tax return was completed which return was or will be filed what the filing status was or will be and whether the student or parents filed a Schedule 1 or did so only to claim one or more of the following. You indicated on your 2019-20 FAFSA that you did not file a 2017 tax return and do not plan to file a 2017 tax return.

Offer period March 1 25 2018 at. For tax year 2020 the IRS is postponing the deadline for all individual. Please provide a signed and dated statement explaining you did not file and will not file a 2017 tax return.

11 26 Financial Aid High School Presentation Presenter Thomas D Foga Associate Director Of Financial Aid The College Of New Jersey New Ppt Download

Finaid Financial Aid Information Filing Taxes Moving To Florida Ameriprise Financial

Guide To Filing Taxes With Student Loans Nerdwallet

11 26 Financial Aid High School Presentation Presenter Thomas D Foga Associate Director Of Financial Aid The College Of New Jersey New Ppt Download

Learn How The Student Loan Interest Deduction Works

Irs Tax Transcripts Financial Aid Office Suny Buffalo State College

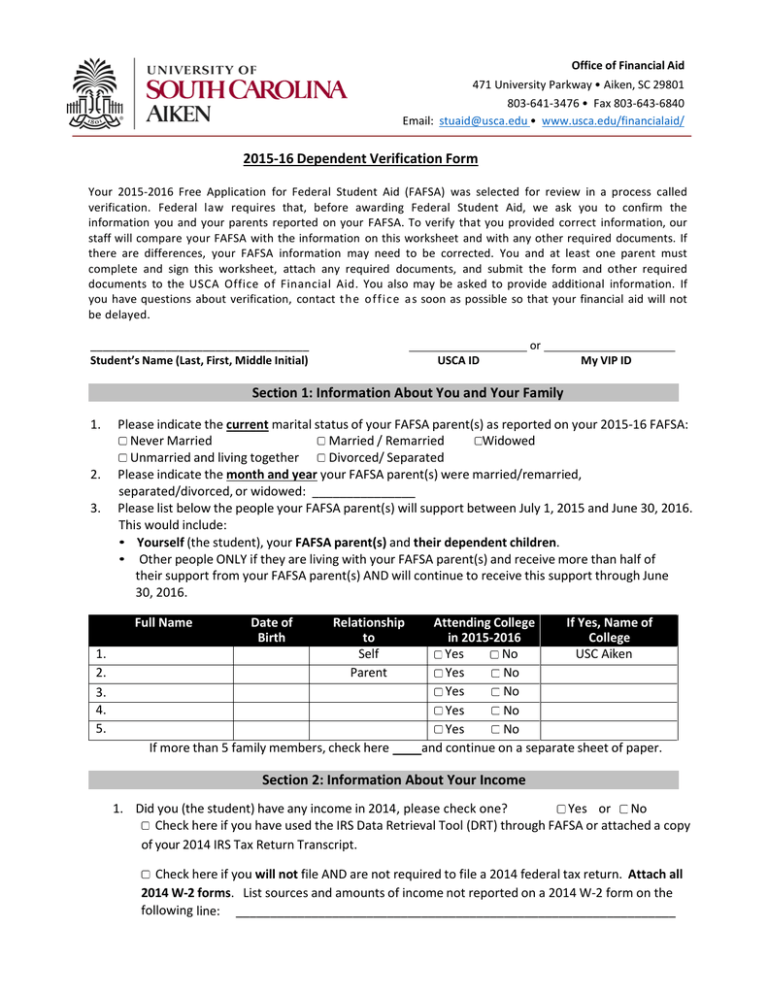

2015 16 Dependent Verification Form

Director Of Financial Aid Ppt Download

Trying To Apply For Financial Aid As A Independent Adult Apparently All The Possible Reasons For Not Applying With Parents Info Don T Count Thus Forcing Me To Include My Parents Info If

Comments

Post a Comment